Almost half of marketers plan budget cuts in the second half

Despite lockdowns easing and the threat of the pandemic receding in the UK, at least for now, 30% more marketers are planning to cut their budgets than increase them in the second half of the year.

Almost half of marketers are planning to cut their budget commitments, a third to cut marketing campaigns and half to reduce hiring in the second half of the year, suggesting the fallout from the coronavirus pandemic and lockdown is not easing.

Almost half of marketers are planning to cut their budget commitments, a third to cut marketing campaigns and half to reduce hiring in the second half of the year, suggesting the fallout from the coronavirus pandemic and lockdown is not easing.

A survey of 500 UK-based marketers conducted by Marketing Week and sister title Econsultancy found that 43.9% are planning reduce their marketing budget commitments in the second half of the year compared to the first six months. Just 14.2% are planning to increase them and 29.2% plan no change, meaning a net 27.9% of marketers are planning to reduce budgets.

The proportion who said they would cut the number of marketing campaigns in the second half was 31.2%, with 27.5% leaving them the same and 30.9% increasing them.

How organisations are approaching the second half of 2020 in terms of budget and priority

| Increase from H1 | No change from H1 | Decrease from H1 | Net change | |

| Product or service launch | 25.8% | 36.2% | 19.4% | +6.4% |

| Marketing campaign/s | 30.9% | 27.5% | 31.2% | -0.3% |

| Marketing budget commitments | 14.2% | 29.2% | 43.9% | -29.7% |

| Strategic initiatives | 38.7% | 26.9% | 14.5% | +24.2% |

| Technology or infrastructure spending | 21.3% | 27.4% | 24.5% | -3.2% |

| New hires | 9.8% | 26.6% | 47.4% | -16.8% |

On new hires, 47.4% say they plan to reduce hires and just 9.8% to increase, leaving a net 37.9% dropping.

The figures are a stark contrast to predictions for ad spend in the second half, with many predicting a rebound. Brands including McDonald’s, Coca-Cola and Adidas have all said they will reinvest in marketing to boost their businesses as lockdowns loosen, but this data suggests many are still concerned about the pandemic’s impact on the economy and consumer spending, as well as uncertainty over a second wave.

The 500 marketers questioned were spread across sectors and size of company, with 12.9% having revenue of more than £1bn, while 20.7% had revenue of between £1m and £10m.

However, the data also suggests that while marketing budgets may not see an expected boost in the second half, other areas of marketing are getting increased focus. Some 38.7% of marketers say they plan to increase strategic initiatives such as digital transformation or a restructure in the second half, compared to the 14.5% who plan to reduce them.

Similarly, more marketers are planning to increase product launches than decrease them, at 25.8% versus 19.4%. The survey did not measure if this increase was partly due to product launches that were delayed from the first half of the year because of the lockdown.

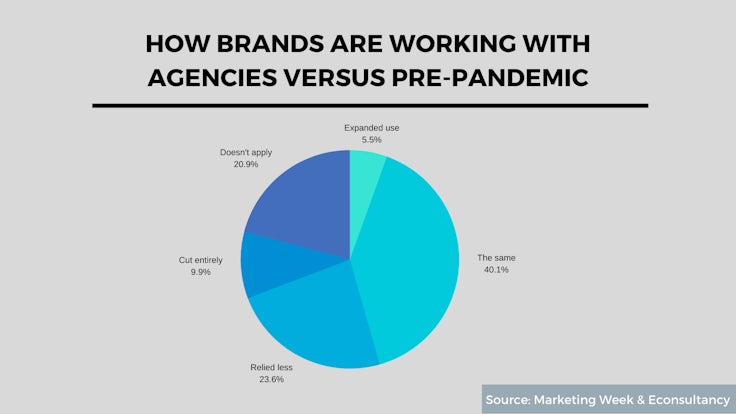

The pandemic has also impacted marketers’ relationship with agencies, if they had one pre-pandemic. While 40% say the relationship has stayed the same, 24% say they have relied less on agencies and 10% that they have cut them completely.

Just 5.5% say they have expanded their use of agencies.

The impact of Covid-19 on consumers and clients

The impact of Covid-19 on consumers and clients

The decisions over where to allocate spend and resource come as more than 80% say they have seen either ‘some’ or a ‘strong’ trend towards consumers delaying major spending decisions. More than three-quarters have seen older consumers using digital services and 85% faster adoption of digital features than in the past.

More than eight in 10 say this has impacted customer journeys.

For B2B businesses, 85% have seen delays in decisions over spending and almost 70% delays in payment schedules. Here, too, there has been demand for new products, features or services among 60% of respondents and changes to the customer journey among 70%.

In terms of their own companies, 53% say they have seen faster decision making, versus 38% who say they have not (and 9% with no opinion), 57% greater autonomy for team members versus 30% who have seen less, and 75% greater empathy for colleagues versus 18% for less. Some 60% think there has been better communications across teams or functions, compared to 33% who think this has been worse.

However, marketers are more closely aligned on whether communication between people at different levels of seniority have improved. Some 45% believe it has but 39% believe it has not, with 16% undecided.

The impact of Covid-19 on consumers and clients

The impact of Covid-19 on consumers and clients

Comments