The wrong and the real of marketing effectiveness

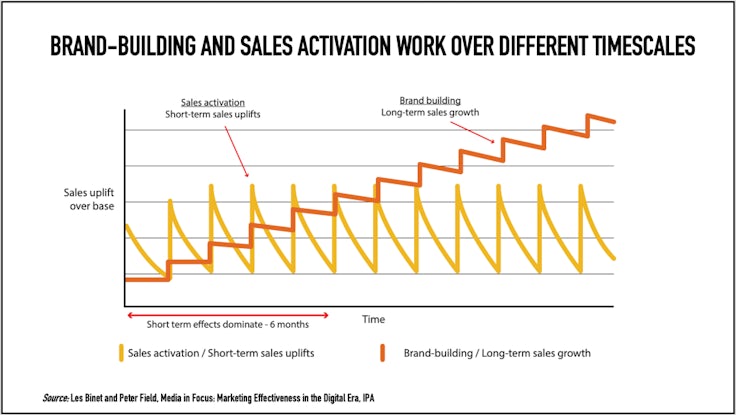

Peter Field and Les Binet have shown us a model for how short- and long-term marketing work together but the reality is achieving this in practice is hard.

The chart above is probably the most famous theoretical illustration of how advertising works. But in the seven years since it was published there has been very little serious discussion of how it actually reflects the experience of everyday brands. You know, the ones that sell functional products using average creative; the ones that don’t end up in the IPA awards databank.

The chart above is probably the most famous theoretical illustration of how advertising works. But in the seven years since it was published there has been very little serious discussion of how it actually reflects the experience of everyday brands. You know, the ones that sell functional products using average creative; the ones that don’t end up in the IPA awards databank.

It’s not because of a shortage of experience. Behind non-disclosure agreements, econometricians like me see the real world long and short of it week in week out. We engage with the messy reality of life where budgets are limited, CMOs don’t last in their jobs and CFOs are sceptical. We see the role that advertising actually plays.

And the truth is that although the chart is right about how advertising works, it’s often wrong about what the real world looks like.

That is, of course, intentional. The chart is a model that sets out to educate not describe. Its message is that there is a limit to what sales activation can do for growth, and beyond that limit you need brand-building.

Strategist and effectiveness champion Tom Roach and I reviewed 20 years’ worth of past projects and found that message holds up, but the real world teaches other lessons too. One is that many brands get years of significant growth by scaling up short-lived sales activation. Another is that following the orange line in the famous chart is not profitable for some advertisers and too risky for many others.

Here’s what else we found.

Finding 1: Many brands do experience what Les Binet and Peter Field’s chart describes

In our review of past projects, we found many real-world brands with incremental sales from advertising similar to the chart below.

It shows the case of a semi-fictional advertiser composed from the experience of several real-world brands. This advertiser’s email activity worked well to drive sales in the week it mailed and the week just after.

It shows the case of a semi-fictional advertiser composed from the experience of several real-world brands. This advertiser’s email activity worked well to drive sales in the week it mailed and the week just after.

But, just as Les and Peter’s chart predicts, the business didn’t begin to see growth until it increased its investment into longer-lived brand-building activity on TV.

Finding 2: Modern brands often grow by scaling up sales activation

We also found many real-world brands with an experience like the chart below.

This advertiser enjoyed several years of growth by gradually increasing always on sales-activation online. After that it began to see diminishing returns, so that incremental sales reached a plateau and driving further growth required investment into brand-building.

This advertiser enjoyed several years of growth by gradually increasing always on sales-activation online. After that it began to see diminishing returns, so that incremental sales reached a plateau and driving further growth required investment into brand-building.

When it took this step, it produced growth both directly and by increasing the effectiveness of sales-activation.

Marketers that traverse this route to growth have an eye not only on the benefits of advertising but also the costs. Data-driven tools for managing search, social, display and online video make it easy to see an estimate of the advertising cost of each sale (cost per acquisition). Using these figures, they calculate that sales-activation is a more profitable route to growth than brand-building.

Communications can drive growth and brand-building is the only way to sustain it over the long term, but it is hard.

Many of them are right. There are always a number of potential customers researching or shopping online who are in the market and not loyal to a competitor. Businesses with a reasonably strong product offer and a well targeted message can convert these people into a sale very cheaply.

However, this approach can only go so far. Once brands reach a certain size, continued growth means reaching outside the readily available pool of customers. In turn, this means converting people who are loyal to competitors or bringing different people into the market, tasks that typically can’t be done with sales-activation.

Further growth means wider reach, richer creative and media channels that can hold attention – in short, brand-building.

The conclusion is the same as Les and Peter’s – you need brand-building for sustained growth – but the picture is very different. That’s how Tom Roach and I came up with the modern steps chart above, which we hope will prove to be a useful complement to Les and Peter’s one.

The conclusion is the same as Les and Peter’s – you need brand-building for sustained growth – but the picture is very different. That’s how Tom Roach and I came up with the modern steps chart above, which we hope will prove to be a useful complement to Les and Peter’s one.

Finding 3: In the real world, brand-building is uncertain and risky

The third set of examples in our past projects is advertisers whose experiments with brand-building don’t initially work. They either don’t turn out to have long-lived effects or don’t offer a positive return on investment.

Some, like the advertiser in the chart above, do eventually find the right combination of creative and media channel. In the chart, initial experiments with social only had a short-lived effect and TV creative X was not strong enough to produce a long-lasting effect.

Some, like the advertiser in the chart above, do eventually find the right combination of creative and media channel. In the chart, initial experiments with social only had a short-lived effect and TV creative X was not strong enough to produce a long-lasting effect.

It was only when the advertiser switched to creative Y on TV and radio that advertising was able to deliver growth.

But not every advertiser’s pockets are deep enough to sustain experimentation until it hits a successful formula. In the example below, four brand campaigns on TV were tried and found to have neither long-lived effects nor a positive return on investment. After evaluation the advertiser understandably gave up and reallocated budget away from brand and into short-term sales activation online.

These examples don’t provide a model for successful advertising. They are never going to be immortalised in a stylised chart that has a viral life of its own. But they are important, not least because they are numerous. In our research, there were many more cases like these than trouble-free take offs into sustained growth.

These examples don’t provide a model for successful advertising. They are never going to be immortalised in a stylised chart that has a viral life of its own. But they are important, not least because they are numerous. In our research, there were many more cases like these than trouble-free take offs into sustained growth.

It is an immensely frustrating situation for marketing directors and CMOs. Most that I talk to are very familiar with the long and short of it, but they find its recommendations hard to put into practice. Brand-building often requires large budgets, and, as we have seen, there is a very real risk it is an investment that won’t pay back.

The uncertainty creates a catch 22. Businesses don’t know in advance whether the creative is good enough or whether they’re using the right media channels, and this makes it very difficult to commit the budgets needed to make a success of any creative/media channel combination.

Econometrics from a credible provider is the only evidence that can break the deadlock. Attribution is incapable of assessing long-lived effects and brand trackers are too far removed from the metrics the CFO really cares about. Without it, the outcome is typically inaction because brand-building plans just don’t make it past the CMO’s boardroom pitch for the money.

Real world brands need to learn from failures as well as successes

Together the real-world examples outlined above tell a clear story. Communications can drive growth and brand-building is the only way to sustain it over the long term, but it is hard.

As an industry, we should do more to help. So far, we are guilty of focussing on success stories and repeating narratives that are not easily attainable for many businesses. We don’t celebrate the long and often frustrating work that advertisers and their research partners carry out in search of the right blend, but perhaps we should.

Even more importantly, we should do a better job of drawing out the lessons from this work. Commissioning a great creative and putting a lot of money behind it may be a route for growth, but as a piece of advice it’s not helpful. CMOs need to know how, and importantly they need to know how to make the whole thing a lot less risky.

In the real world, that’s where success comes from.

Comments