Just 10% of brands in the UK excel at customer experience

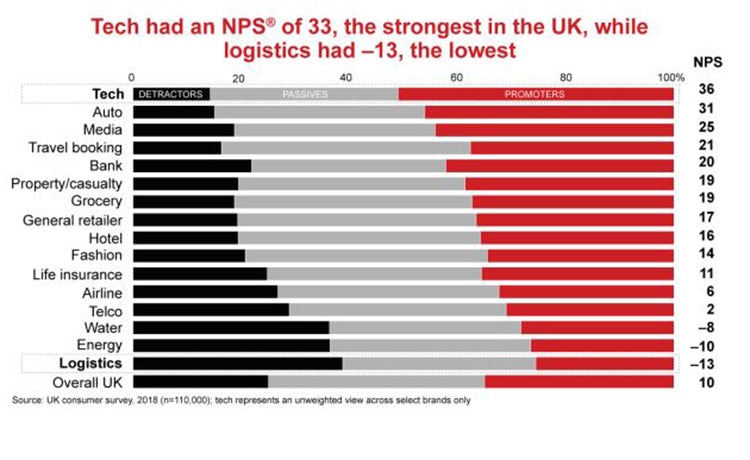

The tech industry leads the way in customer satisfaction, while the logistics, energy and water sectors lag far behind, according to new research from the company behind NPS shared exclusively with Marketing Week.

Only 10% of brands in the UK have a net promoter score (NPS) of 40 or more, with logistics, energy and water emerging as the worse sectors for delivering on customer satisfaction.

Only 10% of brands in the UK have a net promoter score (NPS) of 40 or more, with logistics, energy and water emerging as the worse sectors for delivering on customer satisfaction.

Insurer NFU Mutual (70) is the company with the highest NPS in the UK, according to Bain & Company’s first UK Consumer Study shared exclusively with Marketing Week. This is followed by First Direct (63), Volvo (49), Netflix (49) and Amazon (44).

By industry, the tech sector has the strongest overall NPS (36), followed by automotive (31) and media (25). Conversely, logistics is the worst-performing sector with an NPS of -13, followed by energy (-10) and water (-8).

The fact that just 10% of the 190 brands surveyed appear to be delighting customers is “disappointing”, although not overly surprising, argues Stanford Swinton, partner at Bain & Company.

While each of the brands in the top 10% has their own recipe for success, he notes common ingredients.

“Be known for something and measure success one customer journey at a time. These companies deliver great customer experiences consistently, which translates into how they deliver great end-to-end customer experience,” says Swinton.

“They create a culture that handles things like complaints really well. One of the findings in the study is that it’s not the number of complaints that matters, it’s how you handle those complaints. If you think about what goes into a company to be able to handle customer complaints, it’s really a litmus test for how important the customer is to you.”

| UK Consumer Survey – brands with an NPS of 40 or over (alphabetical order) | |

| Amazon | Metro Bank |

| Age UK | Nationwide |

| Audi | Netflix |

| Bank of Ireland | NFU Mutual |

| BMW | Spotify |

| First Direct | Tesco Bank |

| Honda | Toyota |

| Land Rover | Volvo |

| Mercedes-Benz |

The study, conducted in collaboration with market research company MaritzCX, benchmarked the customer experience delivered by more than 190 brands in 15 industries across the UK. For every brand Bain & Company collected at least 50 customer responses, and up to 200, taking the total number of customer responses to 120,000.

Researchers asked consumers to rate how likely they were to recommend a company to their friends or family. Scores of nine or 10 signify consumers that are likely to promote a brand; consumers that give scores of seven or eight are deemed passives; while a score of six or less means the consumer is a detractor. The NPS is then calculated by subtracting the percentage of detractors from the percentage of promoters.

According to this analysis, the industries leading the way are the ones investing in saving time for customers and simplifying the experience, Swinton explains. A lack of communication and an inability to manage perceptions are key issues for the sectors languishing at the lower end of the NPS spectrum.

“Often we get a lot of feedback on utility companies or telcos around the price consumers pay for the service, when in actuality the value for money is very good,” Swinton explains.

“Often we get a lot of feedback on utility companies or telcos around the price consumers pay for the service, when in actuality the value for money is very good,” Swinton explains.

“There’s a perception that ‘I pay more than other customers for other utilities’ and often the companies in those sectors aren’t managing those perceptions well.”

However, even in poorly performing sectors there are brands delivering positive experiences. Ovo Energy, for example, is the highest-rated energy provider with an NPS of 27. Swinton notes that what Ovo has done well is build a relationship with consumers that ensures the brand is relevant.

Going beyond category

While Ovo Energy is the best performer in the energy sector, Amazon (44) comes top in technology, Volvo (49) in automotive and Netflix in media (49). Skyscanner is the best performing company in the travel booking sector (31), Aldi in grocery (38), John Lewis in general retail (39) and Burberry in fashion (26).

Premier Inn (29) emerges as the brand with the highest NPS in the hotel sector, while Three (18) is the best-rated telecoms company and Royal Mail (11) is the strongest performer in logistics.

Banks and airlines tend to have the widest range of NPS scores, according to the Bain & Company research. Customer satisfaction in the banking sector ranges from an NPS of -21 at the bottom to 63 for First Direct at the top, while in the airline sector the spread runs from -44 at the bottom to 38 for Virgin Atlantic.

Significantly, First Direct scored a higher NPS than Amazon, which should give a category like banking a lot to think about.

“There’s an assumption in industries like banking, which are quite mature, that there’s a natural ceiling to great customer experience. Customers won’t love a bank and they will never be as good as a technology company. What we can see is that’s not true,” Swinton explains.

“We have banks that have higher levels of advocacy than the highest tech company in the UK today. That should provide a sense that regardless of industry you can deliver great customer experience and have loyal customers.”

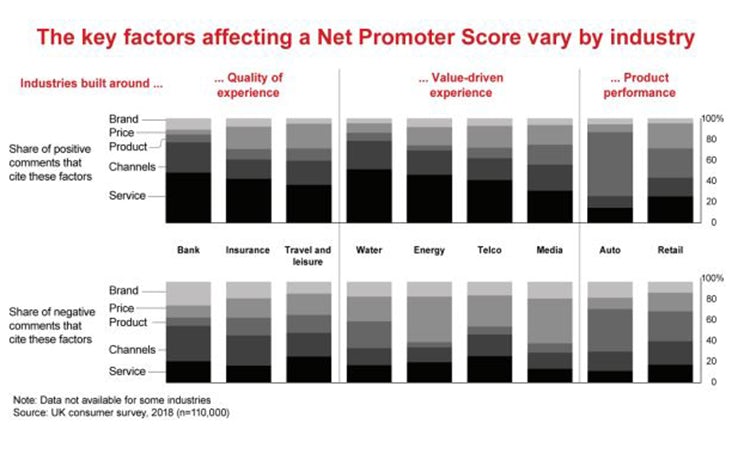

The research also suggests that different industries are driven by different measures of customer satisfaction. In the energy sector, for instance, price is the biggest measure of negativity, while service is the major source of positive comments.

In the automotive sector, meanwhile, product quality is the biggest factor affecting both positive and negative customer sentiments.

“Very often we work with companies we find are investing in the wrong areas because it feels like a good idea, but it’s not necessarily aligned with where customers are saying they value differentiation the most,” Swinton states.

“Very often we work with companies we find are investing in the wrong areas because it feels like a good idea, but it’s not necessarily aligned with where customers are saying they value differentiation the most,” Swinton states.

“You need to understand that your industry might not be the same as other industries, but also there are other archetypes. Telcos, media, energy and water are all value-driven, experience-based sectors and companies can look at each other for examples of what works in those industries and borrow learnings.”

In addition, the study found that brands build customer loyalty through a variety of different factors. To test this idea, the team at Bain & Company categorised feedback about each of the individual brands based on 20 dimensions of experience.

NFU Mutual was found to appeal to customers most as an ethical brand, while Burberry resonated in terms of brand quality and Virgin Atlantic excelled on the measure of quality of service.

Skyscanner appealed most around ease of service, First Direct led on mobile experience, and Marks & Spencer topped the ranking for physical experience, while Barclays took the lead on customer relationships.

Aldi was rated most appealing on price, Sainsbury’s for rewards and Amazon Prime for membership.

Innovation can take many forms

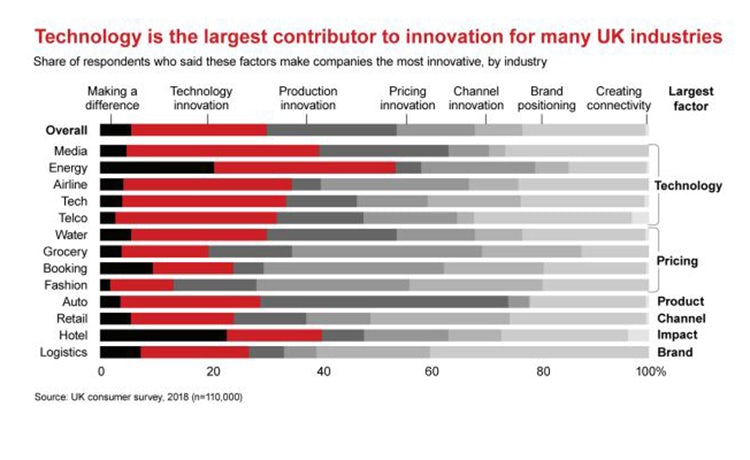

Based on the number of top of mind mentions from respondents, Sky was found to be the most innovative brand in the survey, followed by Amazon, logistics firm DPD, Tesla and John Lewis.

The data shows that what constitutes innovation differs according to the sector. While in the automotive sector product innovation is considered the biggest source of innovation, technology is seen as the biggest contributor to innovation in media.

“Innovation is not only around technology. We often equate it to how Tesla has built the doors for its car or the latest Dyson gadget, but that’s not necessarily the way consumers see innovation,” Swinton explains.

“Innovation is not only around technology. We often equate it to how Tesla has built the doors for its car or the latest Dyson gadget, but that’s not necessarily the way consumers see innovation,” Swinton explains.

“They can see innovation in pricing, proposition, the service experience, the different ways channels are applied. There’s a number of different ways to think about innovation.”

Innovation can also be seen as a forerunner for improving NPS. If DPD, for example, can deliver on the promise of innovation over time its NPS should continue to rise. Conversely, if a brand is not leading the way when it comes to innovation they could see their NPS erode.

Ultimately there is no silver bullet for success, which is why it should be everyone’s job within the company to delight the customer, argues Swinton.

“Being data-driven is very important to understand which customers are happy today and the relative importance of different gaps to the competition. Being able to pick the key gaps and turn them into something truly differentiated is really the opportunity,” he states.

“My advice to CMOs would be not to limit your brand’s competitors just to your industry, because customer expectations are being set everywhere.”

Comments