UK ad growth, post-purchase comms, retail footfall: 5 interesting stats to start your week

We arm you with all the numbers you need to tackle the week ahead.

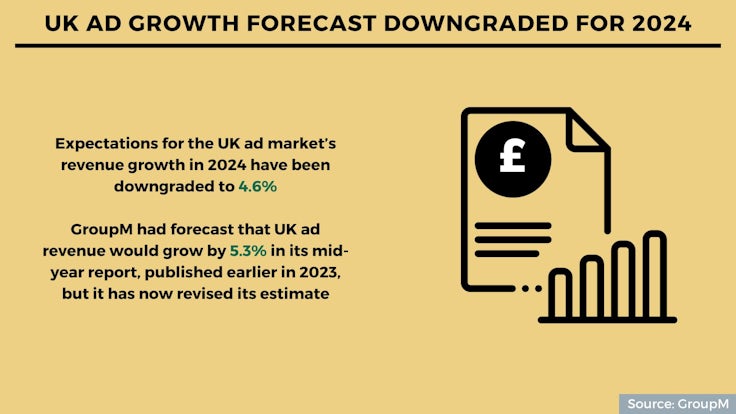

UK ad growth forecast downgraded for 2024

Expectations for the UK ad market’s revenue growth in 2024 have been downgraded to 4.6%. GroupM had forecast that UK ad revenue would grow by 5.3% in its mid-year report, published earlier in 2023, but it has now revised its estimate.

The downgrade comes as the UK faces challenges such as higher interest rates and costs for businesses. The creation of new businesses has also been a driver of advertising growth in the past; however, this has slowed, particularly post-Brexit.

Office for National Statistics data for the first nine months of 2023 showed the creation of new businesses declined by 15.4% versus pre-pandemic levels.

The UK remains the largest advertising market in Europe. UK ad revenue is expected to grow by 4.4% this year. Digital plays a particularly large role in the UK advertising market versus others. It will account for 82.5% of all revenues in 2024.

Source: GroupM

Most LGBTQ+ people believe brands should express opinions on political matters

Most members of the LGBTQ+ community believe brands should be taking an active stance on political and social issues.

Most members of the LGBTQ+ community believe brands should be taking an active stance on political and social issues.

Around three in five (60%) LGBTQ+ people believe brands should express their opinions on political and social issues, compared to 41% of non-LGBTQ+ people. Most (59%) members of the LGBTQ+ community also want to see brands get involved in social issues.

The research, from Outvertising, finds almost two-thirds (64%) of LGBTQ+ people would reject a brand if its views didn’t align with their own, compared to 50% of the rest of the population.

Significantly more LGBTQ+ consumers (58%) want to see advertising with messaging that aligns with LGBTQ+ rights, versus the rest of the population (10%). There is also a desire from the community to see advertising with other messaging, such as around gender issues like #MeToo (45% versus 8% in the non-LGBTQ+ population), environmental rights (63% versus 35%), and human rights (62% versus 24%).

Source: Outvertising and YouGov

Retail footfall shows signs of recovery

Total UK retail footfall decreased by 0.7% in November, versus the same month last year. While the figures are still in a slight decline versus 2022, it is a significant improvement compared to October, when a 5.7% decrease in footfall was recorded.

Total UK retail footfall decreased by 0.7% in November, versus the same month last year. While the figures are still in a slight decline versus 2022, it is a significant improvement compared to October, when a 5.7% decrease in footfall was recorded.

Some major UK cities including Edinburgh (5.7%), Leeds (3.1%) and Birmingham (2.5%) saw increases in footfall in November, while others like Belfast (-7.6%) and Glasgow (-4.5%) saw more notable declines.

Despite a mixed picture, November saw the highest retail footfall levels since July. Storm Ciaran at the start of the month disrupted retail trade but the end of the month saw early Christmas shopping begin.

“It’s worth noting that, while welcome, this recent boost to retailers has been driven by price and promotions-sensitive shopping behaviours,” says Sensormatic Solutions retail consultant EMEA Andy Sumpter. “Discounting events have proved a major draw, with footfall on Black Friday rising 52.4% week-on-week, for example.”

Source: British Retail Consortium/Sensormatic IQ

Consumers receptive to post-purchase communications from brands

Almost three in five (59%) consumers have more confidence in the reliability of post-purchase delivery updates sent directly from a retailer or brand versus a delivery partner.

Almost three in five (59%) consumers have more confidence in the reliability of post-purchase delivery updates sent directly from a retailer or brand versus a delivery partner.

More than half (54%) of respondents also want to receive personalised offers in tracking or delivery updates, suggesting potential for brands to communicate with consumers at this point.

Discount codes were the most popular offer respondents wanted to receive in tracking update communications (61%), followed by free delivery on their next purchase (56%).

While there is potential for brands to positively communicate with consumers post-purchase, it is also important for them to get the experience right. Around half of consumers say they would be likely or somewhat likely to leave a negative review if delivery is delayed, or if they receive an unsatisfactory response to a query about the location of their order.

Source: IMRG/Scurri

Black Friday revenue grows 14% versus last year

Black Friday sales grew ahead of inflation at 14% this year, as shoppers sought out bargains.

Black Friday sales grew ahead of inflation at 14% this year, as shoppers sought out bargains.

Data from ecommerce platform Visualsoft shows the number of orders made over the Black Friday period grew by 12%. The average order value grew slightly, up 2% versus 2022 levels.

Over the full promotional period of Black Friday through to Cyber Monday, revenue increased above inflation rates. The average increase for the four-day period was 8%, with Black Friday revenue up 14% and Cyber Monday up 15%.

Some categories saw particular upticks in sales versus last year. The flooring, rugs and carpets category saw revenues grow by 88% in the Black Friday to Cyber Monday period. Vaping sales were also up by 40% year over year.

On the other hand, electrical goods, which is a category particularly associated with Black Friday, performed worse than last year (down 31% from Black Friday to Cyber Monday). The sector did see a peak in sales prior to Black Friday, suggesting people were moving early to ensure what they wanted was in stock.

Source: Visualsoft

Comments