Diageo: We will not pursue ‘short-term’ market share growth at expense of brand equity

Diageo lost market share in 70% of its portfolio in the six months to the end of December. However, the business will not resort to leaning on price promotions to drive “short-term” share growth at the expense of brand equity, its CEO said.

Driving market share growth has been outlined as a key priority for Diageo as it reported falling sales in the first half of its financial year.

Driving market share growth has been outlined as a key priority for Diageo as it reported falling sales in the first half of its financial year.

The drinks company is clear, however, that it will not pursue “short-term” share if it comes at the expense of brand equity.

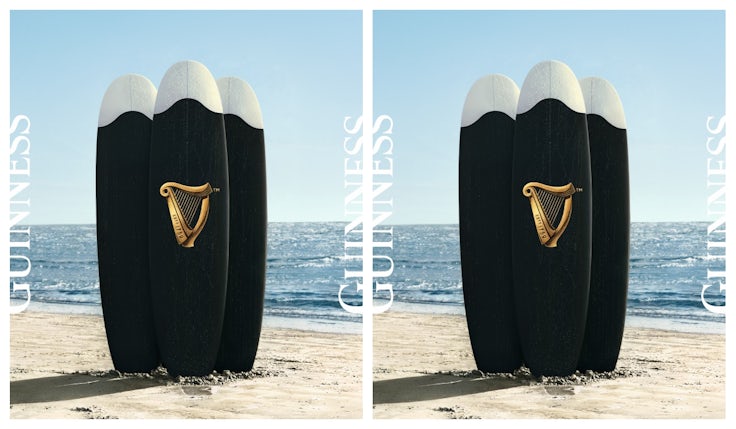

Diageo, which counts brands such as Johnnie Walker, Guinness and Don Julio among its portfolio, saw organic sales value decline 0.6% in the six months ended 31 December 2023. While its volume sales declined 5.2% versus the same period the year before.

In its first half, the drinks business held or grew share in just 30% of its sales portfolio. Although the business did see its market share grow in most European markets, as well as in China and Canada, its share of total beverage alcohol in its biggest market, the US, declined by 17 basis points in the six months to the end of December.

We are not interested in gaining ‘short-term’ share if it comes at the cost of brand equity driven by significant price promotions.

Debra Crew, Diageo

Diageo CEO Debra Crew accepted that the market share losses “look quite stark”. Speaking to investors today (30 January), she attributed it largely to the US, where price competition has intensified, at the expense of Diageo’s brands.

Recovering market share, then, will be a priority for Diageo going forward.

“But to be clear, we are focused on doing this the right way: winning high-quality market share,” Crew said. “We are not interested in gaining ‘short-term’ share if it comes at the cost of brand equity driven by significant price promotions. We manage our business for the long-term.”

Market share is an extremely valuable health measure for brands. Indeed, Marketing Week’s Language of Effectiveness survey found that more than half (50.9%) of marketers believe growing market share is the most important task for a marketing department.

However, speaking to Marketing Week at the time, Peter Field, academic and co-author of The Long and Short of It, warned that the easiest way to drive market share is through price, meaning marketers can be tempted to lean heavily on promotional activity, thus eroding margins.

Are marketers too focused on market share as a measure of success?

Rather than leveraging heavy promotional activity, Diageo is looking to improve distribution of brands where it has lost market share both in the on and off-trade, and utilise innovation, particularly in its whiskey portfolio, where it has seen market share losses. Brand activation will also continue to play a role for the business.

Sustained marketing investment is a key component of Diageo’s pursuit of “quality” market share growth. Speaking in November last year, the business’s CFO Lavanya Chandrashekar told investors that Diageo is committed to “consistent” and “sustained” marketing investment to reach its goals.

Diageo saw its marketing investment increase by 3.8% in the first half. It highlighted its “disciplined” approach to how it spends its advertising and promotional budget.

“We deploy marketing investment in a considered and disciplined way and target increases where we believe we will drive long-term sustainable growth and strong returns,” Crew said.

The business did say that it expects its re-investment rate in marketing to moderate in the second half of its financial year. This is due to high year-over-year comparisons and the company taking advantage of the marketing “efficiencies” it has made.